Welcome to the final installment, Part 3, of our trip through the exciting world of Internal Rate of Return (IRR) and the intricate financial aspects of our Solar + Battery Energy Storage System (BESS) project in the sun-drenched expanses of Northern Chile. In this concluding chapter, we’ll delve into the IRR and payback data for our project, revealing key financial insights.

If you missed out on the technical and financial modeling covered in the previous installments, here are the links for your reference:

Understanding the IRR: A Quick Recap

Before we delve into the IRR data, let’s revisit what IRR signifies. Essentially, it’s a measure of your revenue growth (or losses). A higher IRR indicates a more profitable project. The critical point of reference is the Cost of Capital (or Weighted Average Cost of Capital – WACC), which sets the minimum rate at which project profits must grow to cover equity sponsorships and debts. If the IRR exceeds the Cost of Capital, it means the project generates positive cash flow above what’s needed to service its financial obligations. If the IRR falls short, the project struggles to meet these obligations.

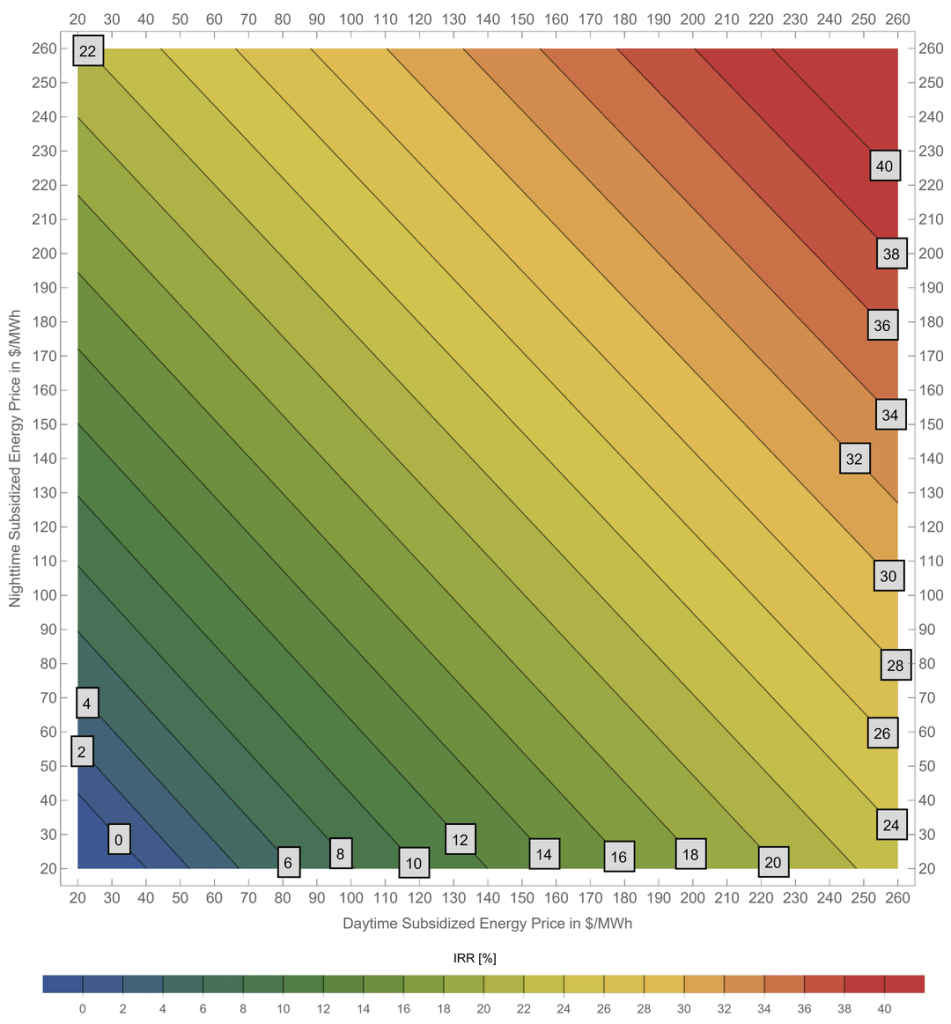

IRR: Insights Considering Subsidized Energy Prices

In the graph below, we’ve plotted the IRR for our project as a function of daytime and nighttime subsidized energy sale prices. These prices are determined by Power Purchase Agreements (PPAs) and include subsidies or incentives specific to solar and BESS projects in Chile, expressed in $/MWh.

Here’s a quick interpretation:

- 5% to 8% IRR: Represents an acceptable project with potential, although projects typically require an IRR greater than 8% for financing and execution (8% typically achieved at a price ratio of $60 daytime / $70 nighttime).

- 10% IRR: Marks the point where the project starts making financial sense and becomes more likely to secure funding (typically achieved at a price ratio of $70 daytime / $80 nighttime).

- Above 14% IRR: Signifies a very attractive project that stands a strong chance of getting financed and built (typically achieved at a ratio of $70 daytime / $120 nighttime).

Please note that these reference numbers are industry-based and can vary depending on industry, technology, project lifetime, market share, and location.

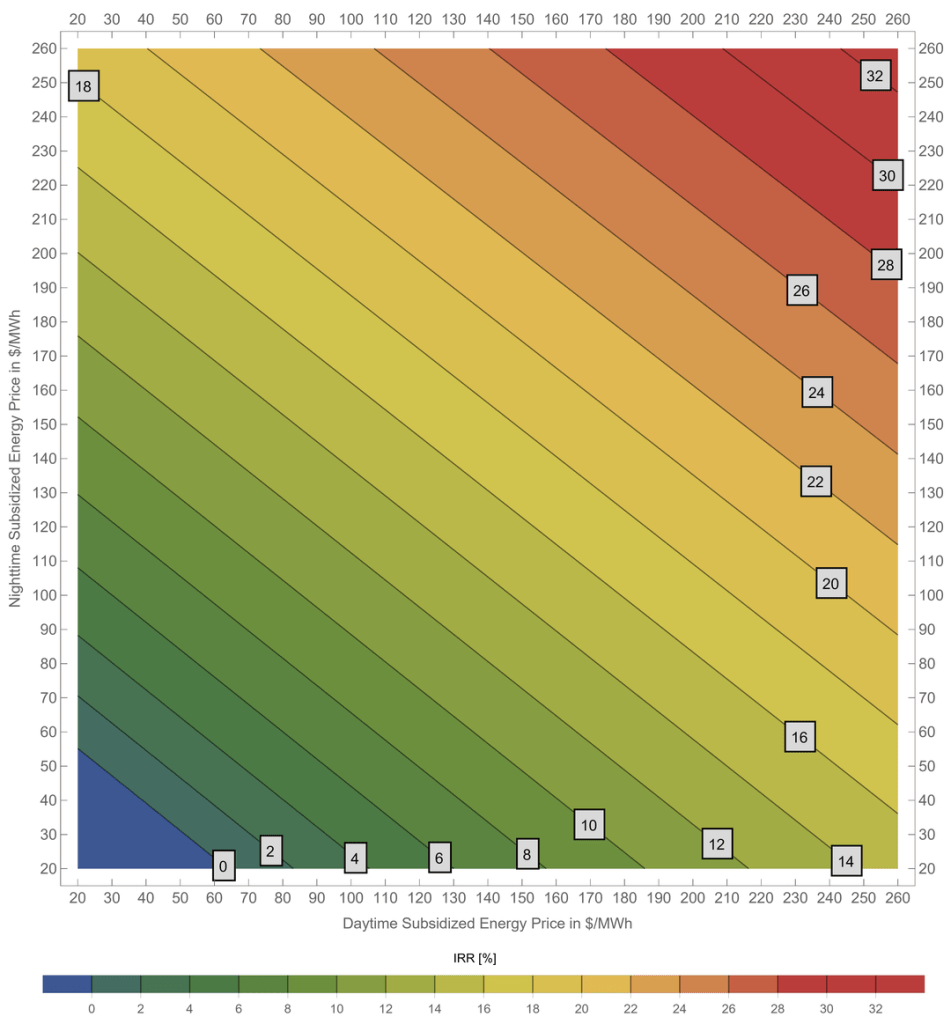

For context, we’ve included two additional plots showcasing how the IRR for a similar project would differ if located in Central or Southern Chile. As expected, irradiation levels decrease as you move southward. Consequently, projects in Northern Chile tend to be more profitable. In Central Chile, a $60 / $100 price ratio is required to reach an 8% IRR, while in the South, a $100 / $100 ratio is needed.

Exploring Payback Periods

We’ll also examine the payback period, which represents the time it takes for the project to start generating positive cash flow after all initial investments. Payback periods below 10 years are generally considered more acceptable, but this can vary depending on project nature and location. Please note that for this current representation, we will explore a simplified version of the payback period considering only CAPEX, OPEX and revenues (no consideration of debt repayment during operation). For our Northern Chile project, at $70 / $120 subsidized energy sale prices, we achieve a 14% IRR with a payback period of 7.6 years—indicating a very attractive investment opportunity.

Conclusion: Wrapping Up the Series

With this, we conclude our 3-part series on IRR and the Solar + BESS project in Chile. I hope you found this journey informative and insightful. I very much enjoyed the modeling and customizing of plots, and here to discuss any concepts or answer questions you may have.

Thank you for joining me on this exploration of financial feasibility in the renewable energy landscape. Stay tuned for more exciting insights in future posts!

Leave a comment