In the strategic domain of project financing, where each decision charts the course to success, discussions often revolve around overall profitability and returns. However, the equally crucial aspect of maintaining a robust working capital throughout project execution tends to take a back seat. This post delves into the essence of Working Capital, focusing on its components, namely Accounts Receivables and Accounts Payables. It illustrates the significance of aligning payment schedules to ensure a smooth cash flow. We’ll explore this concept through a case scenario involving a 11.25MWp utility-scale solar PV project, emphasizing the need for strategic planning to prevent cash flow gaps that could potentially hinder project progress.

Understanding Working Capital

Working Capital is the lifeblood of project execution, representing the difference between a company’s current assets and liabilities. In simpler terms, it’s the capital required for day-to-day operations, encompassing the resources needed to cover short-term expenses such as payroll, supplier payments, and operational costs. Accounts Receivables (AR) and Accounts Payables (AP) play pivotal roles in this financial ecosystem. AR refers to the money owed to the company by clients, essentially the outstanding invoices awaiting payment.

Efficient management of AR is crucial for maintaining a healthy cash flow, ensuring that funds are received in a timely manner. On the flip side, AP represents the company’s outstanding bills to suppliers and subcontractors. Timely and strategic management of AP is equally vital, as it influences the company’s ability to meet its financial obligations and avoid disruptions in the supply chain. The delicate balance between AR and AP, often referred to as the working capital cycle, is a key determinant of a company’s financial health. A well-optimized working capital cycle ensures that the company has the necessary liquidity to meet its short-term obligations, fostering operational efficiency and resilience.

In the context of project management, where cash flows are dynamic and project durations vary, understanding and effectively managing working capital becomes even more critical. An imbalance in the working capital cycle can lead to cash flow gaps, potentially hindering the progress of the project. Therefore, a comprehensive understanding of working capital dynamics, coupled with strategic planning, is paramount for successful project execution.

A Case of a 11.25MWp Solar PV Project: Design, Cost, and Cash Flow Dynamics

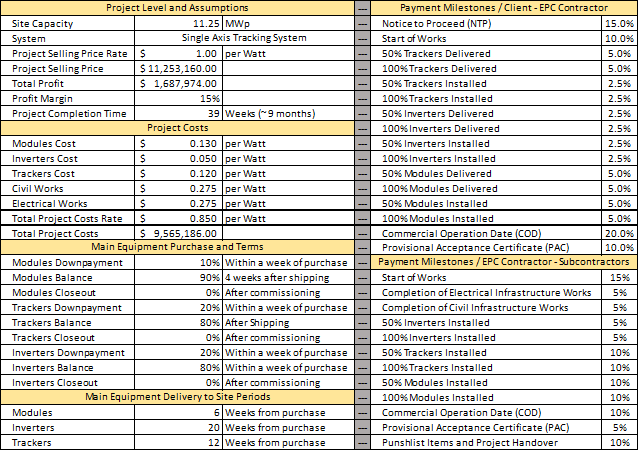

Let’s review a hypothetical scenario where we, as the Main EPC contractor, are tasked with constructing a solar project for a client. The project involves intricate design, cost assumptions, and payment milestones. A detailed table showcases these components, setting the stage for a comprehensive analysis of cash flow dynamics.

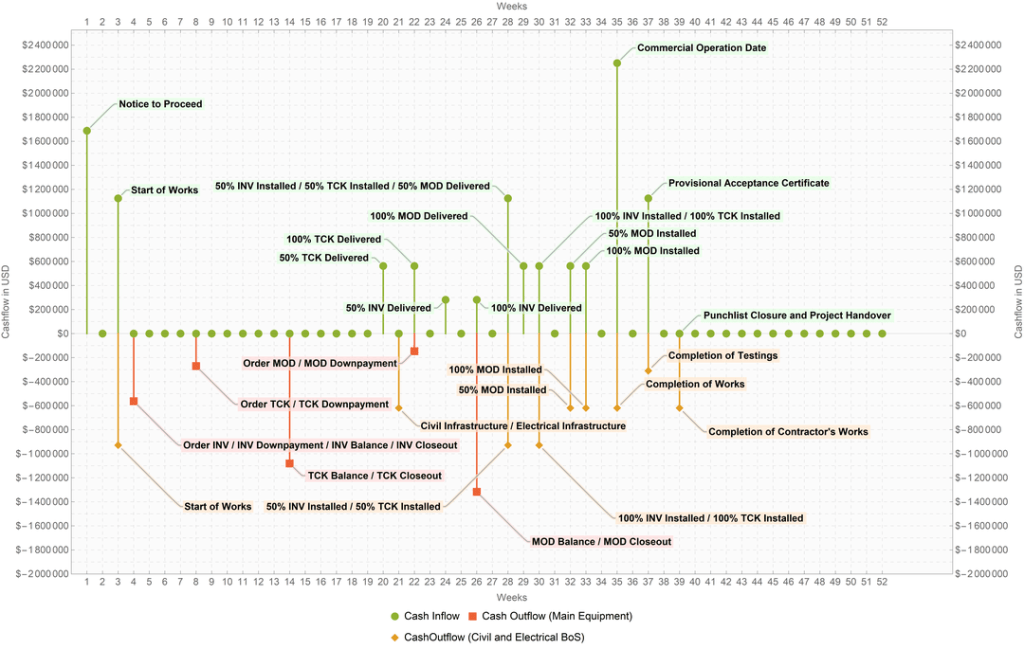

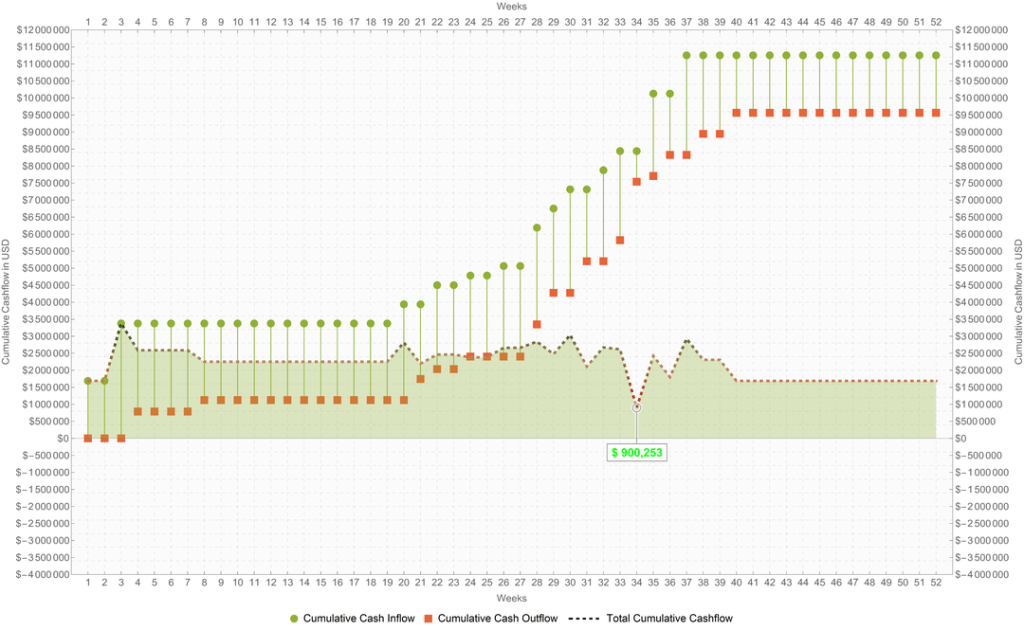

A visual representation of the project’s cash flow over 52 weeks provides insights into potential deficits. By analyzing the cumulative cash flow, we identify critical periods where outflows surpass inflows, potentially causing delays. This graphical representation serves as a valuable tool for optimizing working capital.

Optimizing Working Capital: Crafting Recommendations and Financial Tactics

As demonstrated in the example above, the EPC Contractor’s cash flow will experience a deficit during construction, potentially impeding the project’s progress and successful completion. The EPC Contractor may reach a juncture where acquiring additional equipment becomes challenging, or meeting payment obligations to subcontractors becomes unattainable, leading to potential work stoppages. This situation could evolve into a perpetual cycle of halts, creating a cascade of interruptions with no clear resolution. To ensure a seamless flow of funds throughout the project, we implemented strategic optimizations.

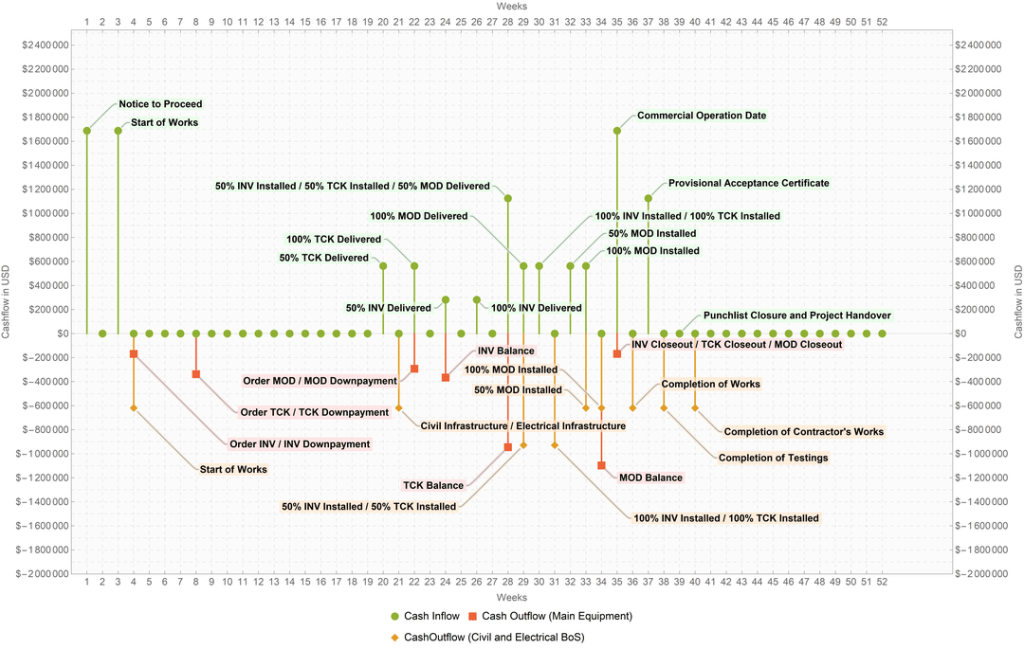

- Synchronized Subcontractor Payments: We adjusted the payment schedule for subcontractors involved in equipment installations and handovers. Payments to subcontractors are now released at least one week after receiving the respective payments from the client. This synchronization minimizes the risk of cash flow gaps, providing a buffer and maintaining financial fluidity. We have made adjustments to the milestone payments, reducing the Start of Works milestone payment from 15% to 10%. Conversely, we have increased the percentage for the PAC testing payment milestone.

- Strategic Downpayment Increase: Recognizing the importance of negotiation in supplier relations, we increased the downpayment for main equipment purchases. This adjustment not only fosters goodwill with suppliers but also grants the flexibility to negotiate more favorable dates for closing balance payments.As evident, balance payment due dates have been extended beyond the delivery to site dates. Additionally, a small percentage has been introduced to be retained until the site has been commissioned and site acceptance tests have been completed. Following these milestones, the retained percentage would be released to the suppliers.

- Client-Centric Milestone Adjustments: It’s worth noting that some clients may display flexibility in accepting payment milestones that align with the EPC contractor’s financial needs. By negotiating for higher payments at the beginning of the project, the main EPC contractor can ensure a more robust cash flow early on. In the above example, we have successfully increased the Start of Work payment milestone percentage from 10% to 15%, redistributing that percentage from the PAC milestone, which consequently decreased by 5%.

These strategic moves, backed by careful negotiation and a deep understanding of the financial intricacies involved, can contribute to a well-optimized working capital strategy, ensuring the project’s financial health throughout its execution.

Concluding with important insights, we review comprehensive recommendations for EPC contractors to fortify their working capital strategies:

- Front-Loaded Milestone Payments: When negotiating contracts with clients, prioritize front-loaded milestone payments. This proactive approach ensures an early influx of cash, empowering the EPC contractor to tackle initial project expenses swiftly.

- Favorable Supplier Payment Terms: When procuring equipment from suppliers, negotiate advantageous payment terms. While a higher down payment might be necessary, securing extended payment periods for the balance can alleviate immediate financial strain. In some cases, the option for interest payments on delayed balances may be worthwhile to maintain financial flexibility.

- Aligning Subcontractor Contracts: Organize subcontractor contracts to synchronize payment milestones with those agreed upon with the client. This alignment facilitates a seamless flow of cash, preventing any potential gaps that could impede project progress. A well-coordinated payment schedule ensures that funds smoothly transition from the client to the EPC contractor and onward to subcontractors, maintaining financial fluidity throughout the project.

- Emergency Cash Reserves: Allocate a portion of the working capital for emergency cash reserves. Unforeseen challenges can arise during project execution, and having a financial buffer provides a safety net to address unexpected expenses without disrupting the project timeline.

- Holistic Collaboration between Involved Departments during Project Budgeting: Ensure simultaneous collaboration on all disciplines involved in cash flow and accounting during project budgeting. Input from various teams, including finance, engineering, procurement, logistics, executive, and legal, is imperative to work concurrently on all fronts. This collaborative effort aims to ensure that all contracts (client, suppliers, and subcontractors) align in a manner that guarantees positive cash flow throughout the entire execution period of the project.

These recommendations collectively can contribute to a robust working capital strategy, enhancing an EPC contractor’s ability to navigate the complexities of project execution with financial dexterity.

Epilogue and Final Notes

In the intricate dynamics of project financing, we find that prioritizing the pragmatic management of working capital can become the linchpin for success. As we’ve discussed, the delicate balance between project profitability and the strategic handling of working capital is a dynamic challenge. By embracing the recommendations outlined earlier—prioritizing front-loaded milestone payments, negotiating favorable supplier terms, aligning subcontractor contracts, and maintaining emergency cash reserves—EPC contractors can not only weather the uncertainties of project execution but also thrive in the competitive project management arena. As we navigate this financial terrain, it becomes evident that ensuring a continuous flow of funds is paramount for the timely and efficient execution of projects. Ultimately, success lies in the mastery of both the financial intricacies and the operational challenges, contributing to sustained excellence in project execution.

Leave a comment